The Federal Book has hinted they are likely to taper their bond getting program later this year. If you sell points you want to have the funding repaid before you get to the recover cost point so you are not paying the bank a lot more interest than you would certainly have if you selected not to get points. If the home buyer is rather selling factors, cheap timeshares the opposite holds true.

My broker told me I needed to pay a complete point just to reduce the price.25%. For example, if you're only being billed half a factor, or 50 basis points, you would certainly determine it by inputting 0.005 right into a calculator and also increasing it by the loan quantity. The lawful paper which promises real property as safety for the settlement of a finance. The promise finishes as well as the home loan is pleased, when the funding is paid-in-full. The optimal percentage factors that a car loan's rates of interest can raise by during the entire life of the loan. A financing created building which is utilized as an investment where the debtor occasionally receives rental revenue, or may look for cost gratitude to profit from.

- A home mortgage application is submitted to a loan provider when you apply for a financing as well as includes info that establishes whether the funding will certainly be approved.

- Purchasers who pay off the financing prior to the break even date while utilizing unfavorable factors will certainly make money on the factors.

- Whether you are buying or re-financing a home or have various other home mortgage needs, placed our over 30 years of lending knowledge to help you.

- For example, you speak to a finance policeman, telling him/her that you intend to secure– ensure your price at closing– your rate for 60 days.

- The objective of this question entry tool is to provide basic education and learning on credit history reporting.

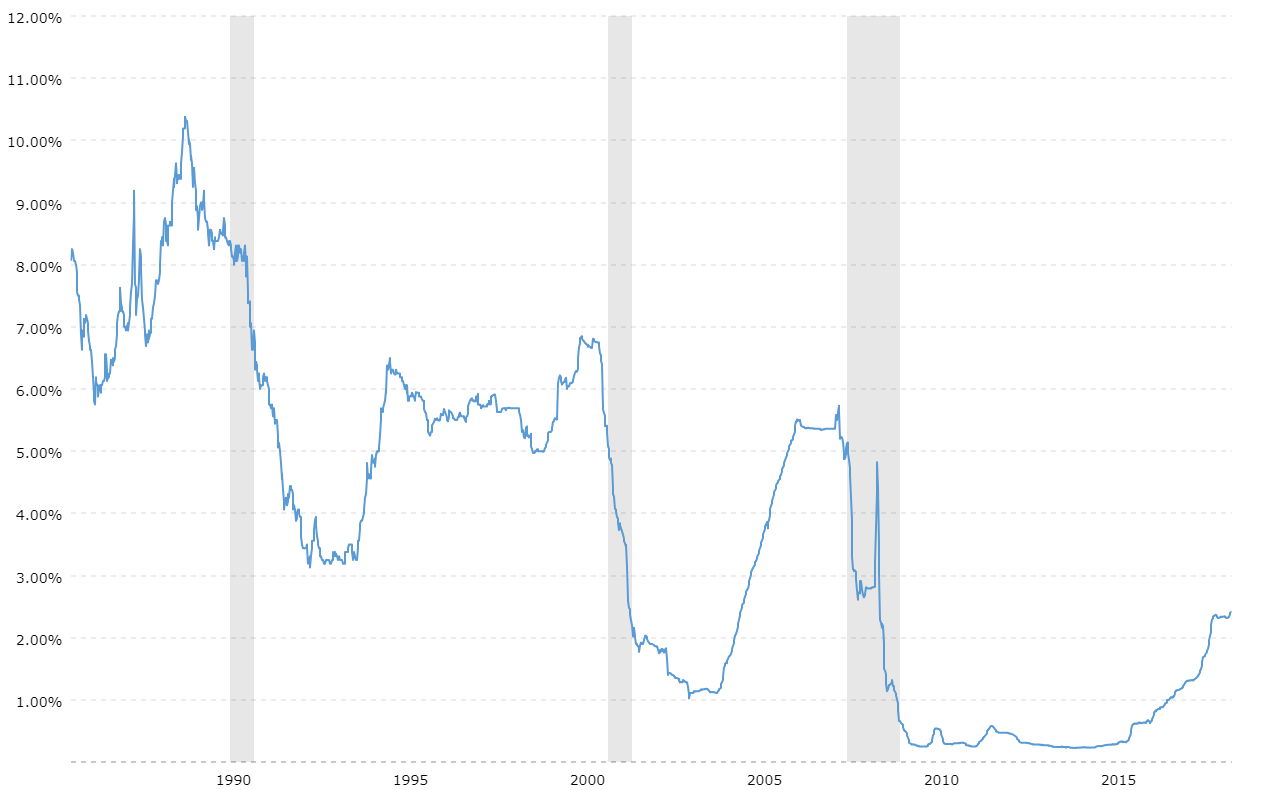

Today, basis points are generally quoted in regard to portion yet can also be estimated as decimal worths where each decimal value amounts to 0.01%. For example, if the yield-to-maturity is 12%, then it would be equivalent to 120 basis points. In this article, we will clarify what Browse this site basis points are, how they are used, and why they are so crucial in finance and also investments. We will likewise clarify where the term basis point originates from, as well as why individuals utilize it rather than portions. Getting or refinancing a home can be an amazing time, yet do not let it divert you from the details. Comprehending exactly how basis point adjustments influence your finance interest rate will certainly help you end up being a smarter consumer as well as might also save you cash.

Pupil Car Loan Overviews

Phil, line 801 is the source cost, as well as line 803 is your modified source cost. They coincided, not double, since you didn't pay discount points or receive a lending institution credit history, which is why line 802 is empty. Currently allow's presume you're just paying 2 points out of your very own pocket to make up the broker. It would merely show up as a $2,000 origination cost, without any credit or cost for points, since the price itself doesn't include any kind of points. Don't obtain shaken off if the finance. police officer or lender uses basis points to explain what you're being billed. It's just an expensive means of saying a portion of a factor, and also can actually be used to deceive you.

Basis Points

A mortgage loan produced the function of constructing a new house or redesigning an existing one. Intrigued in looking for a variable rate of interest home mortgage from CIBC? Amongst the "huh"- deserving words that you might encounter in your economic undertakings is the "basis factor," a global term that is used to specify rates of interest systems. Unfortunately, without a solid understanding of a few of the frequently utilized terms, loaning, investing and financial investment techniques, as well as planning your financial future can be tough.

The cash created from the higher rate of interest will certainly cover those charges. An ahead of time fee charged by the loan provider, different from interest but developed to increase the total yield to the lending institution. Typically revealed as a percentage, as well as calculated based on the financing amount. A rate of interest that is decreased during the preliminary duration of the funding

Usually, you should only pay these types of points if you plan to wfg promotion hold the car loan enough time to recover the ahead of time costs by means of the lower rate. The optimal percent points that a financing's rate of interest can raise by throughout any type of adjustment period throughout the life of the finance. A mortgage loan created the function of financing a real estate acquisition.

No person seems to have a straight response on this, however with any luck a tax professional or your CPA can supply a conclusive response. Some state you can use modified source, yet if that number includes things like processing as well as underwriting costs, those aren't truly factors. For the record, the credit scores results in a greater rates of interest, indicating more passion will certainly be paid by you over the life of the lending and also possibly deductible yearly you pay your home mortgage. There's a great deal of confusion concerning this from what I have actually seen as well as even the IRS doesn't appear to clarify it effectively.